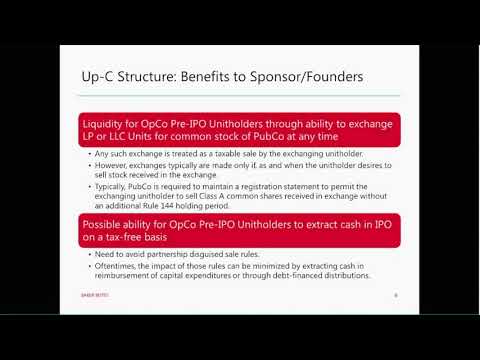

Good morning or good afternoon, depending on where you are. Welcome to our Baker-Bots corporate series presentation. Today, we're going to be talking about the UP-C structure and related issues. I'm AJ Eric's, a corporate partner in the Houston office, and presenting with me today is my partner Steve Marcus from our Dallas office, who is a tax specialist. If you have questions, we're going to try and save those for the end of the program. But if during the program a question occurs to you, you can email that to Marisa McDonald. That's Marisa, with one "R" and two "S's," dot McDonald at baker-bots.com. Her email address should also be on the invitation that you received. This program has been approved for one hour of Texas and California CLE credit. We'll also provide New York CLE credit, one hour for professional practice trend transitional and non-transitional. Later in the program, we will provide the CLE number. Please write that down. We'll repeat it a couple of times. You'll need to include that number in the affirmation form. The affirmation form was included in the link to where there was LinkedIn in your invitation for the reminder that you received yesterday. You'll need to add that number to the form to get CLE credit. If you didn't receive the invitation or need an affirmation form, you can also email Erisa. Again, it's Erisa, with one "R" and two "S's," McDonald at Baker-Bots.com. A recording of this webinar will be circulated in the next week and will also be posted on our firm website, Baker-Bots.com. Now, let's start out by giving an overview of the UP-C structure. As background, we'll contrast this to the traditional corporate structure. In a traditional corporate structure, the chart looks a lot like what you see here. But we would ignore...

Award-winning PDF software

1120-reit 2025 Form: What You Should Know

S. Income Tax Return for Real Estate Investment Trusts 10-Q -Form 1120-REIT is now on the U.S. Public Documents page! Check it out. More than just a form, this is a whole new way for the IRS to deal with the REIT. How to use Form 1120-REIT, U.S. Income Tax Return for Real Estate Investment Trusts Use the form to fill out U.S. income tax forms for corporations and trusts. Fill in the 1120-REIT with Form 941, U.S. Individual Income tax return. If you're a corporation, use Form S-Corporation return. A summary of Form 1120-REIT, U.S. Income Tax Return for Real Estate Investment Trusts: The form was filed after May 21, 2021, and the date of mailing was January 2, 2022. The form can now be filed with most tax forms that have a Form 941 extension. Part I of the Form 1120-REIT, U.S. Income Tax Return for Real Estate Investment Trust, includes the following: a. General information B. Company information C. Ownership information D. Company history E. Financial statements and related controls (if applicable) The form may be submitted with any tax return. The form does not have to be filed separately from other income tax returns. The Form 1120-REIT can't be used for the following: Income tax returns. S. Tax return. G. A trust tax return. W. A loan income tax return. The Form 1120-REIT is required, but no additional tax is withheld from the Trust's income. If an additional tax is due, the tax may be paid directly to the IRS when the Form 1120-REIT is due. The Form 1120-REIT doesn't apply to taxable income of the Trust or to income from a partnership, LLC, or other pass-through entity, and it can't be used to reduce the amount or defer tax on income received from a partner, shareholder, or other transferee that is not a partnership or pass-through entity. Additional information and explanation about this form is provided in IRS Publication 523, and IRS Publication 5429 Income Tax Return of a Real Estate Investment Trust.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1120-REIT, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1120-REIT online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1120-REIT by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1120-REIT from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1120-reit 2025