Um, you know, the biggest concern for the foreign investor is the death tax. Quite often, they talk to you about income taxes, we're going to get you that too, but the hub of the tax planning is the death tax. This is because the foreign investor does not have our exemption of almost 5.5 million. The foreign investor has an exemption of only 600,000, and that applies to his worldwide assets. So, if he has 1 million dollars in the United States and has nine million dollars outside the United States, that 600,000 is his exemption. The other party we're going to get into this Tuesday is the income taxation. Right off the bat, the foreign investor would like to use a foreign corporation to own the property. The problem with any corporate structure, as almost all of us know, is double taxation. So, a foreign corporation is a seed park, it's just like a domestic seat court, but they're going to tax us real hard. The hard part about the foreign investor pointing in the name of a formal operational effect, themselves in a position, or through a foreign at the quantity, like the fourth partnership, is the withholding tax on a trip down. And most of you putting Delta that couldn't even with the silver home, you have to do a flip their report see that you're not a foreign person. So, this method is used to address all of these concerns, and what we're going to look at is the ownership by trust. And when I send out that newsletter, we actually had that diagram here, and we're going to get down to that. And I'm looking at the diagram for those of you who know tax loss sections, there are two sections that really are...

Award-winning PDF software

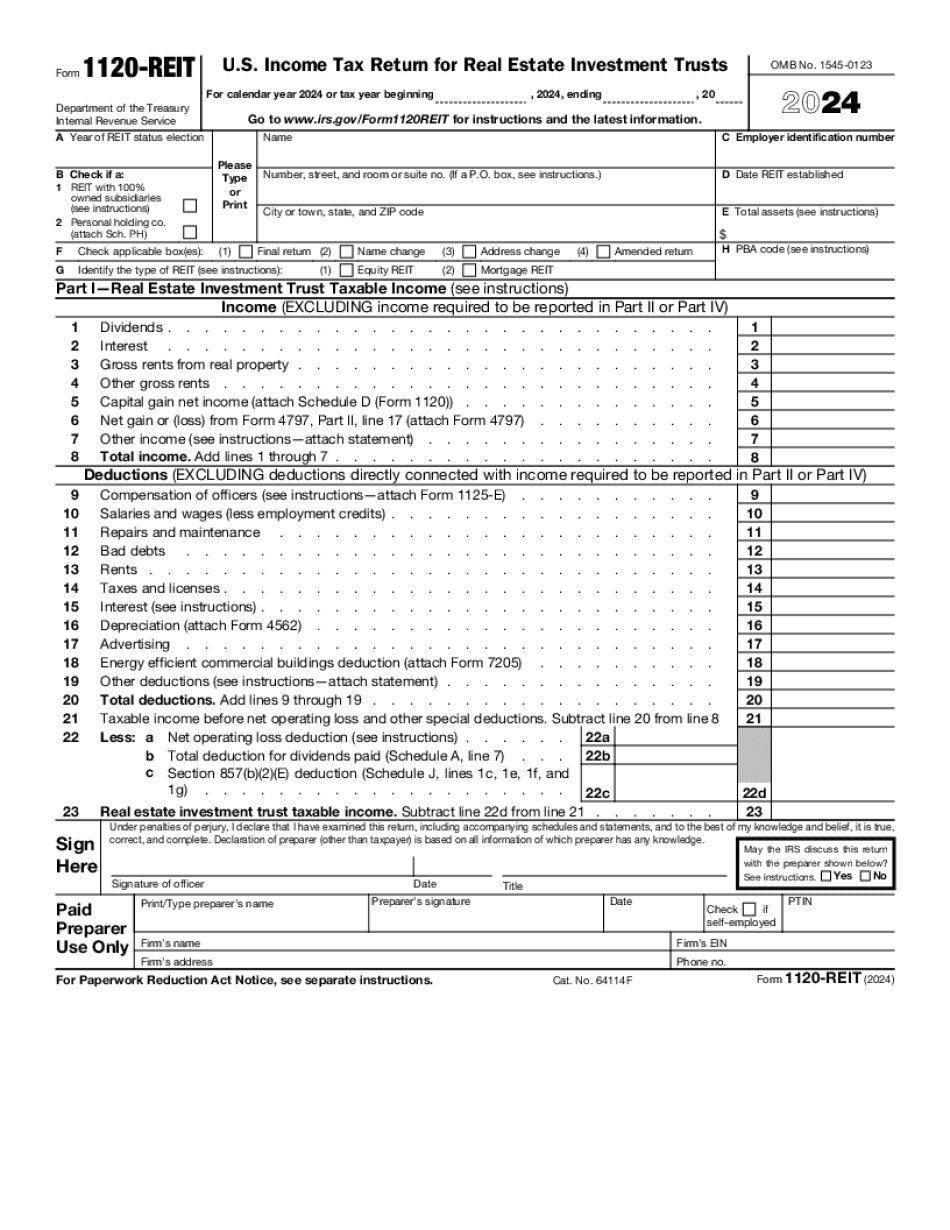

Video instructions and help with filling out and completing Who Form 1120 Reit Shareholders