You own a company. You're gonna get paid not based on value, but based on distribution. How much money did you make this year? Because they tax you based on a per year basis. Could you imagine if the tax rate was just that high? That means that Buffett would be broke. So, you get your dividend statements quarterly. They'll tell you here's what the business is doing and here's how much you made based on the preferred dividends and the distribution. Now, you might be taxed differently depending on how your structure is, and I can't tell you that. You have to talk to the people down at UCP about that. But at that point, it is set up in such a way where you get your k1 at the end of the year and you get your press. So, we give you a report of how much interest you made on your money on top of it. It's very similar to going to a regular traditional company that does it, except for public companies. For public companies, the dividends are what you're going to pay taxes on, not the value, because the value could quadruple and then there's no more left because Uncle Sam took it. Yeah, exactly. Now, if you were to talk to Kevin before you did this, you would use your IRA and self-direct it directly into something like this. And then, now the k1 is sent directly to the IRA and the money goes back to the IRA, so it's tax-deferred. That's why this is so attractive. Typically, most investors have a hard time trying to deal with a 401k IRA because there's a one-by-one deal. Right here, it's okay. Anything goes because we're going according to the regulations.

Award-winning PDF software

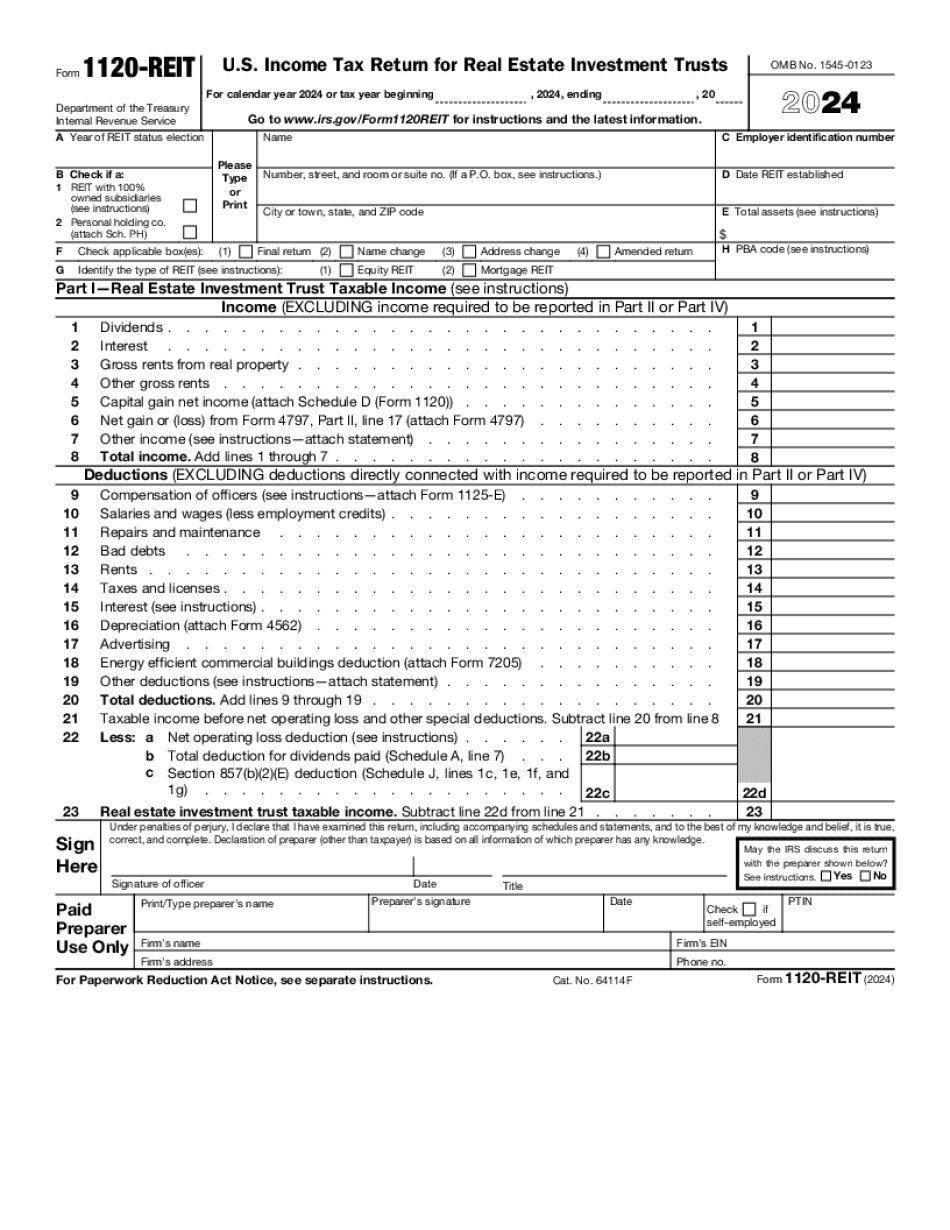

Video instructions and help with filling out and completing Who Form 1120 Reit Nol