Your job is to divide this text into sentences and correct any mistakes. Here is the revised text: Your job? This is something we've talked about before on the show, but I think it's important enough to talk about again, especially given your expertise on this. Let's talk about why 280e is still a thing. Here we are, almost three years after these sales were first implemented, and 280e is still very present. Not only is 280e present, but the IRS is becoming more aggressive towards the industry in enforcing 280e. Okay, real quick, our viewers know what's up, but a quick outline of what 280e is before you get into what I asked you about. The real quick line is, whatever you make, the government's going to take, right? That's the bottom line of 280e. Isn't that taxes in general? Well, for marijuana, this is even more so. 280e was adopted about 30 years ago, and what it does is it disallows all of the deductions that a normal business could take for their normal business expenses. The practical effect is that the tax is about 100 percent or more of your income. What percentage is it for a traditional business? Typically, you'll be looking at 30-35 percent of net income. So we're talking more than twice what normal businesses pay, or what's being paid by marijuana businesses. So Jim's, why is this still an issue three years after these sales, and as you said, they are being more serious about going after cannabis businesses than they were three years ago? We're certain that there are politics on the side of making cannabis illegal again. We're sure that there's politics going on that way. But the IRS's official position is that they are just trying to enforce the tax code....

Award-winning PDF software

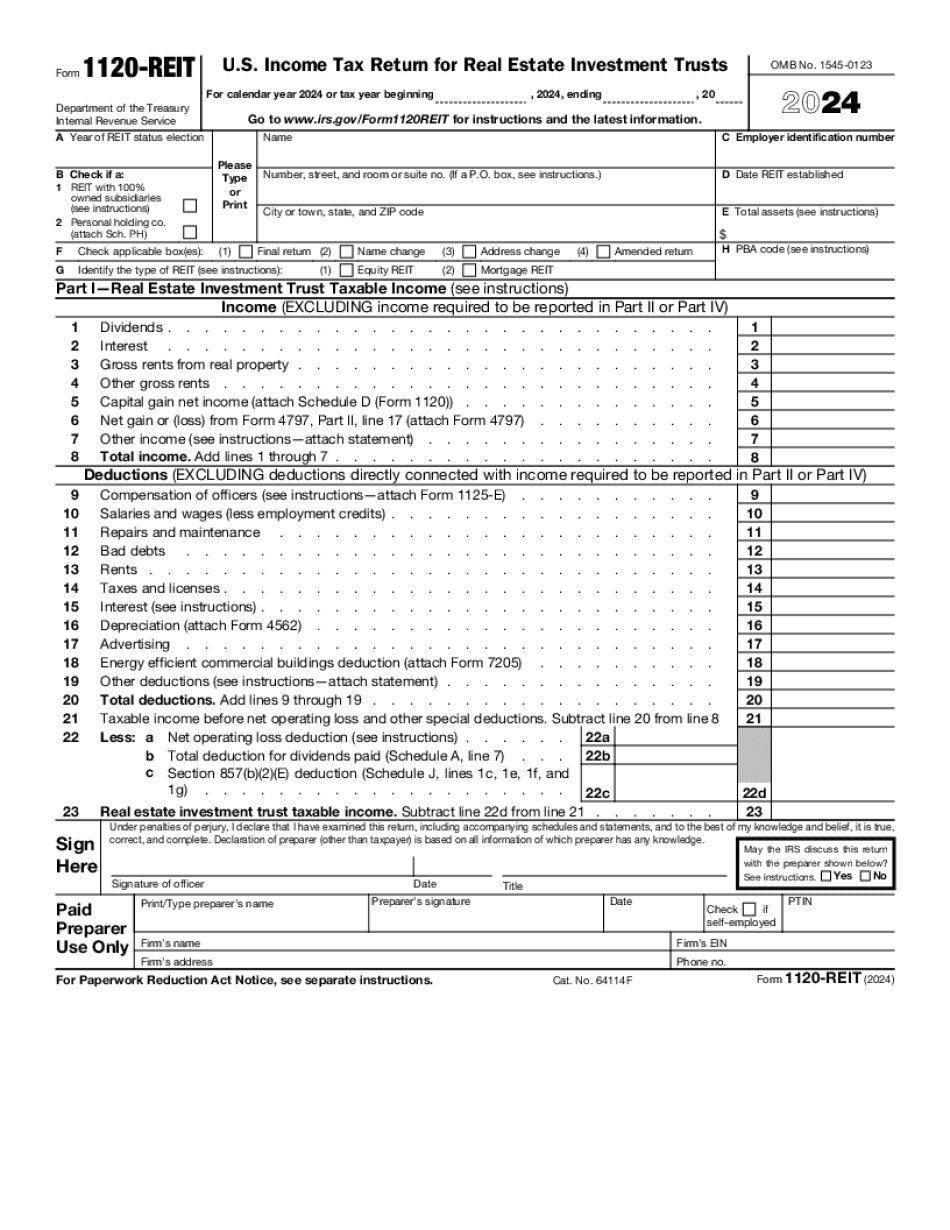

Video instructions and help with filling out and completing Who Form 1120 Reit Includes