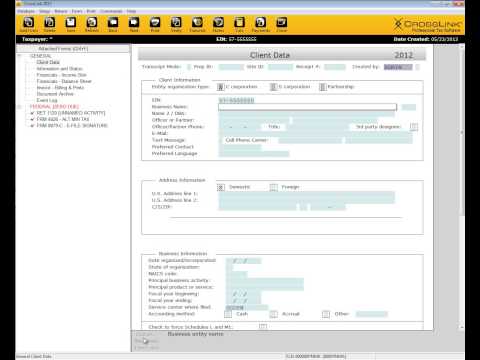

Hello and welcome to this video on getting started with cross-linked business. Our new program allows tax professionals to quickly and accurately complete 1065, 1120, and 1120s returns. The first and perhaps most important aspect of cross-linked business is that it is an extension of the great cross-link program used for 1040 individual returns. It features the same methodology, the same type of client data worksheet, and the same tools to help prepare the tax return. To get started on a business return, simply choose "business returns" from the work-in-progress summaries tax returns section, then add new from the toolbar. You will be prompted to enter and confirm the EIN number of the business, as well as what type of return you want to prepare (1065 partnership, 1120 C Corp, or 1120s S Corp). Once in the return, you will complete the client data just like when doing an individual 1040 return. Please note that the interface will look just like cross-link's 1040 program, with an attached forms list, a toolbar, a menu bar, and an active window featuring the ability to use choices worksheets and form links. After completing the client data, it's important to note that both financial income statements and financial balance sheets allow the tax professional to input data gathered from the business client. That data will then accurately flow to the appropriate fields in the return itself. Other intuitive features of the program include forms automatically being added to the attached forms list when correlating data is input. The 1125 A cost of goods form attached on this return is a great example of an ADD form based on information entered into the financial balance sheet. Similarly, information from worksheets is carried to the actual tax return. Whether working on a 1065, 1120, or 1120s, the program can also import...

Award-winning PDF software

Video instructions and help with filling out and completing Who Form 1120 Reit Adjustment