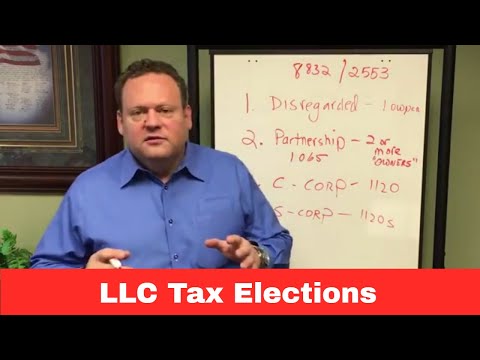

Hi, I'm attorney Bill Brown. I'm checking in to discuss the four different ways that you can elect to be taxed as an LLC or limited liability company. Now, why do you have to elect to be taxed? Well, a corporation, unlike an LLC, has a designated return. So, if you're filing as a C corporation (Form 1120), an S corporation (Form 1120s), or a partnership (Form 1065), an LLC does not have a designated tax return. Now, what you have to do is choose how you want to be taxed as an LLC, and there are four different ways. By default, there are default rules. So, if you're set up this way, then by default, the IRS is going to tax you this way. And if you're set up that way, the IRS, by default, taxes you another way. However, you can elect out or opt out of any one of those defaults and choose one of the four ways to be taxed. Let's look at those four ways. The first is what we call a disregarded entity. That's when you have only one owner or one member of the LLC. It doesn't matter if you have a manager or no manager. If you have one owner or one member, by default, you are quote disregarded for income tax purposes. What does that mean? Well, it means that the IRS is going to ignore the LLC form. You don't have to file a return for it. Instead, you would report all of the income and expenses on this single member owner's return. So, if that were you individually personally, then you would report it on your personal return. If the sole member were, let's say, a C corporation or an S corporation, then it would report the income and expenses on...

Award-winning PDF software

Video instructions and help with filling out and completing How Form 1120 Reit Elections