In this video, we're going to discuss the seven different types of tax-free reorganizations that are listed under section 368 of the US tax code. Let's start with a taipei reorganization. First off, it's called taipei because it's under section 368 a 1a. A type B reorganization would be section 368 a 1b, and so forth. So, type A is an acquisitive reorganization, but what does that mean for B acquisitive? Well, basically, acquisitive means that you've got the acquiring corporation. Let's say that's you, and then you've got a target corporation that you want to acquire. So, what you're going to do is transfer some assets and some of your voting stock in exchange for the target's stock. Now, this is in contrast to a divisive reorganization. The acquiring firm will actually end up creating a second corporation and then transferring some assets to the second corporation, and then sending some stock back to the acquiring corporation, and so forth. We will talk about this later. Getting back to the acquisitive reorganization, which is type A, we've got assets and voting stock being given to the target in exchange for the target stock. This will qualify as a tax-free reorganization if certain requirements are met. The voting stock being given to the target must be at least 40 percent of the consideration being given. Consideration refers to what you're giving to the target, such as assets and stock. The remaining 60 percent could be cash or other forms, but at least 40 percent must be voting stock. One drawback to type A is that it has to comply with the state's merger and consolidation laws, which could require shareholder approval. Another drawback is that you'll acquire all of the liabilities of the target, including contingent liabilities. Type C reorganization, also known as assets for stock,...

Award-winning PDF software

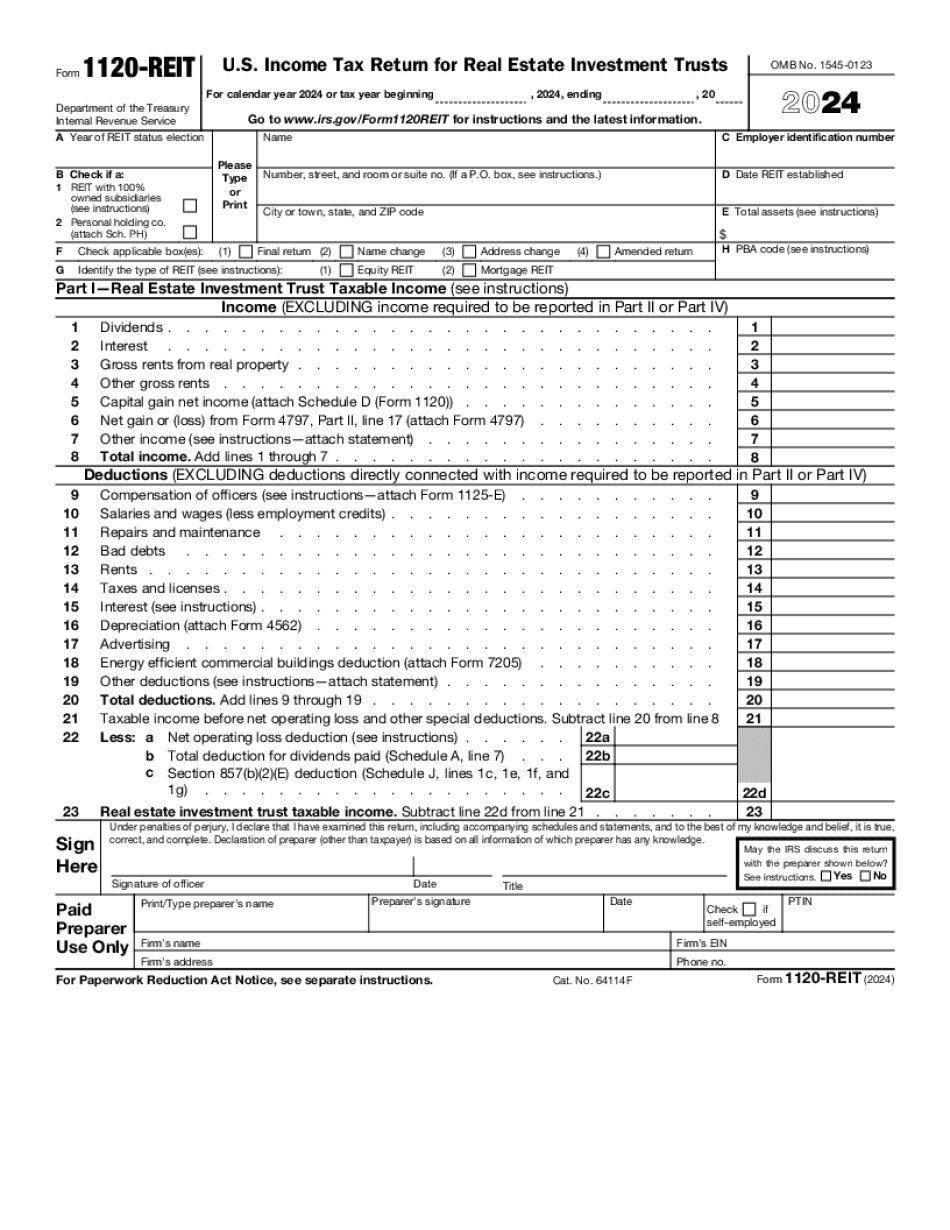

Video instructions and help with filling out and completing How Form 1120 Reit Amounts