Hello, my name is Melissa Skelter and I'm an attorney with the Low Income Taxpayer Clinic (LITC) at Southeastern Ohio Legal Services. Many homeowners are surprised to learn that their efforts to save their homes can have income tax consequences. This is because federal law considers cancelled debt to be income. It's important to understand generally how the IRS deals with this type of income and what you can do to make sure that you don't trade a mortgage debt for a tax debt. When you receive money from a loan, it's not considered income because you have to pay it back. However, if circumstances change and you don't fully pay the debt, then the unpaid portion is normally considered income. This is referred to as cancellation of debt income (CODI). Fortunately, there are several provisions that allow you to exclude this income, which means you will not have to pay tax on it. Cancellation of debt income can result from any type of loan, including credit cards, car loans, and mortgages. The type of loan doesn't matter, just that there's some portion of it that will not be repaid. The debt is considered to be cancelled when there is an agreement that it will not be repaid, when the lender decides not to collect the debt, or when the debt can no longer be collected as a matter of law. In the area of mortgages, you might see cancellation of debt income if the lender agrees to reduce the principal of the loan, if there's a short sale where the lender accepts less than the owed payment in full, if the homeowner transfers a property to the lender's payment in full, or if the home is sold at a sheriff's sale and the lender is unable to collect the full amount...

Award-winning PDF software

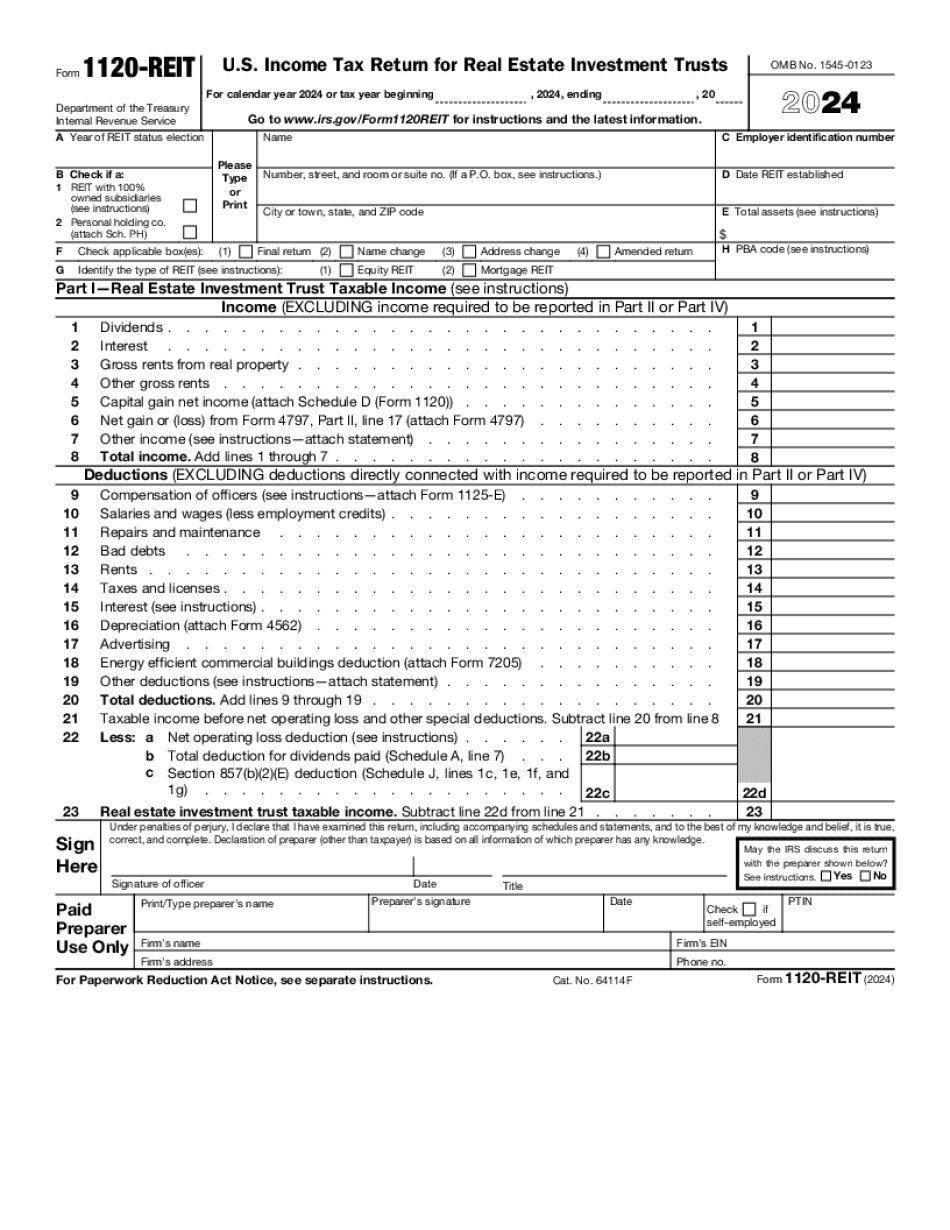

Video instructions and help with filling out and completing Can Form 1120 Reit Foreclosure