Okay, hello and welcome to another financial modelling tutorial. This time around, we're going to be talking about a very specific topic that comes up in mergers and acquisitions. The topic is why deferred tax liabilities get created in these deals. Let's go away from our simple Excel model for a second and just go over here and sort of go through why this matters in the first place. Then, we'll discuss a couple of real-life examples of where these items get created. Deferred tax liabilities are part of the purchase price allocation in any M&A deal. Let's take a quick example. I'm going to pull up this Excel file that we have for United and Goodrich, which is a major deal in the aerospace and defense industry. If you go to the purchase price allocation schedule here, you can see that they have this new item called deferred tax liability. Over here, it's being calculated and is set equal to the total of the PPE write-up and the intangibles write-up times the buyer's tax rate. That's how it's being calculated here. In the purchase price allocation process, most items are going to retain their same value in the balance sheet. However, some of them are going to change. The ones that change the most frequently are PPE and intangibles. The values are sometimes written up or written down, but they change in some way. When that happens, the companies' deferred tax line items change. Now, this is not just something theoretical. If you go to Oracle's filings, for example, they're a very acquisitive company, which is why I picked them. Take a look at their filings in a year, and they'll say something like, "244 million of net tangible liabilities related primarily to deferred tax liabilities." So, they're going through their historical...

Award-winning PDF software

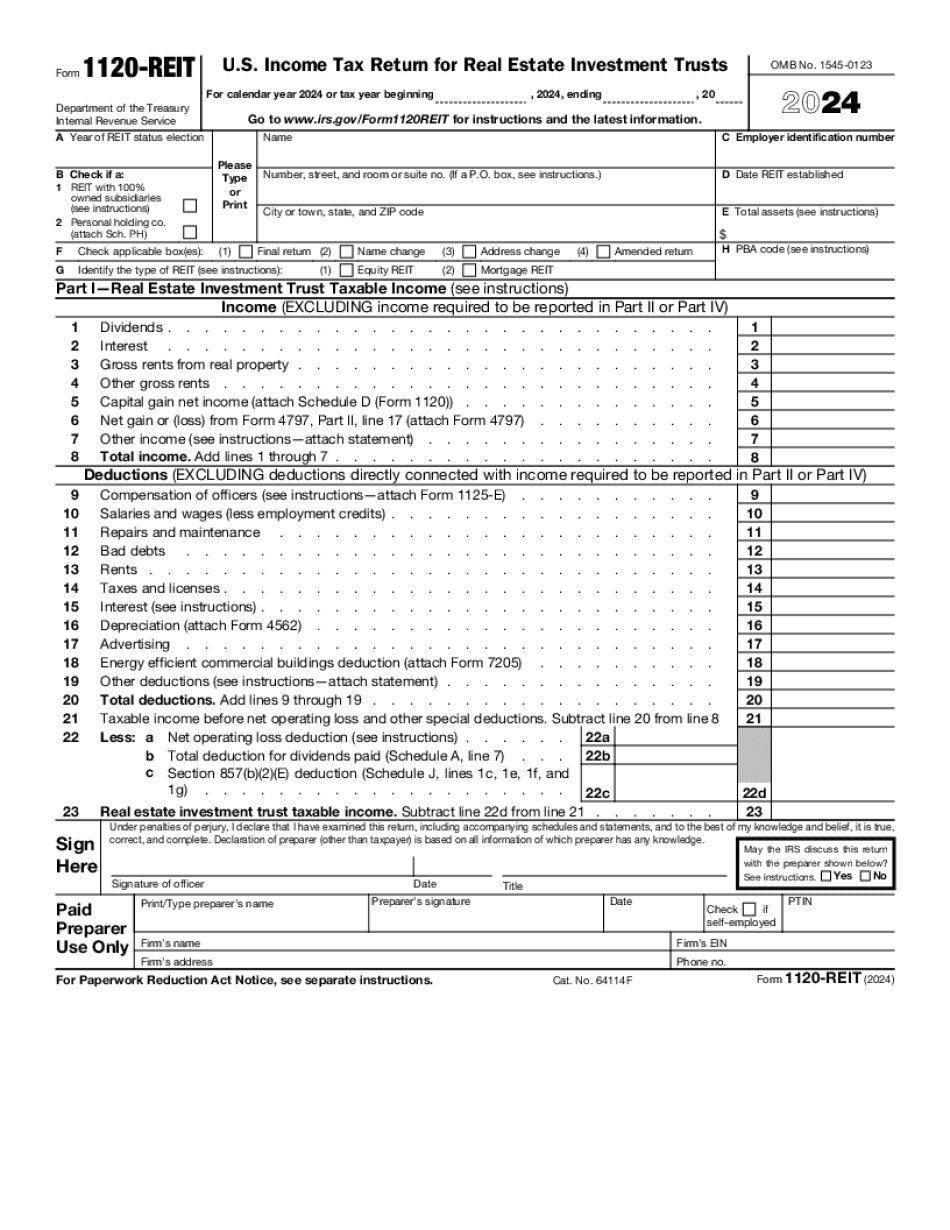

Video instructions and help with filling out and completing Can Form 1120 Reit Assets